With a combination of speed and decisiveness, Phoenix funded this £2.1m development exit loan in just eight working days.

The project

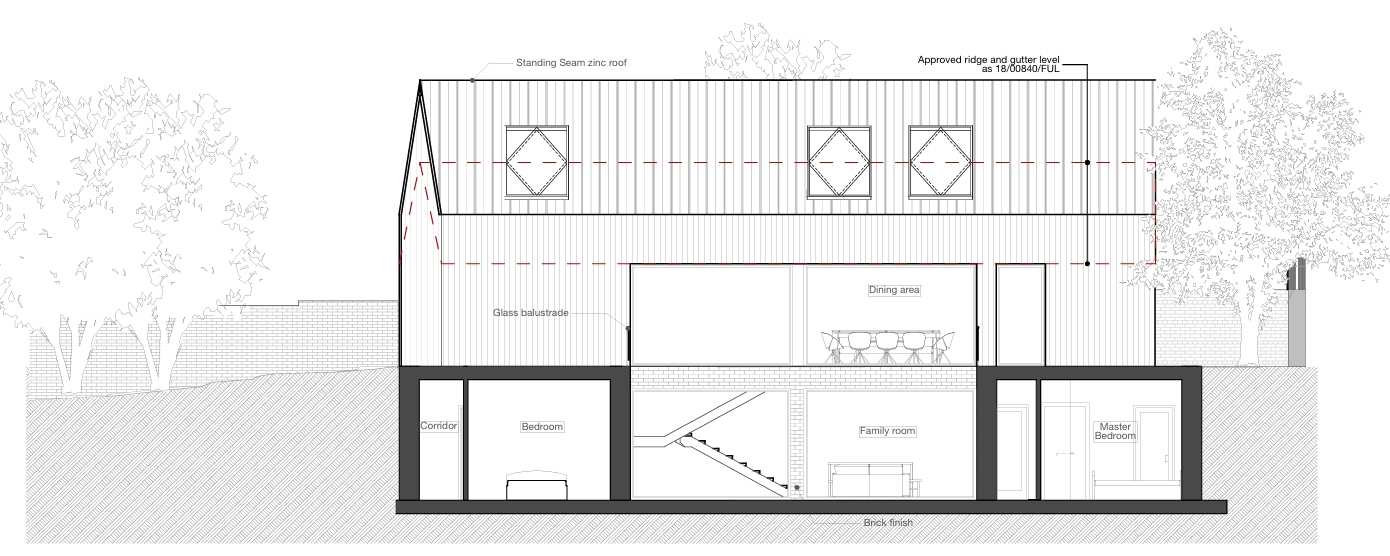

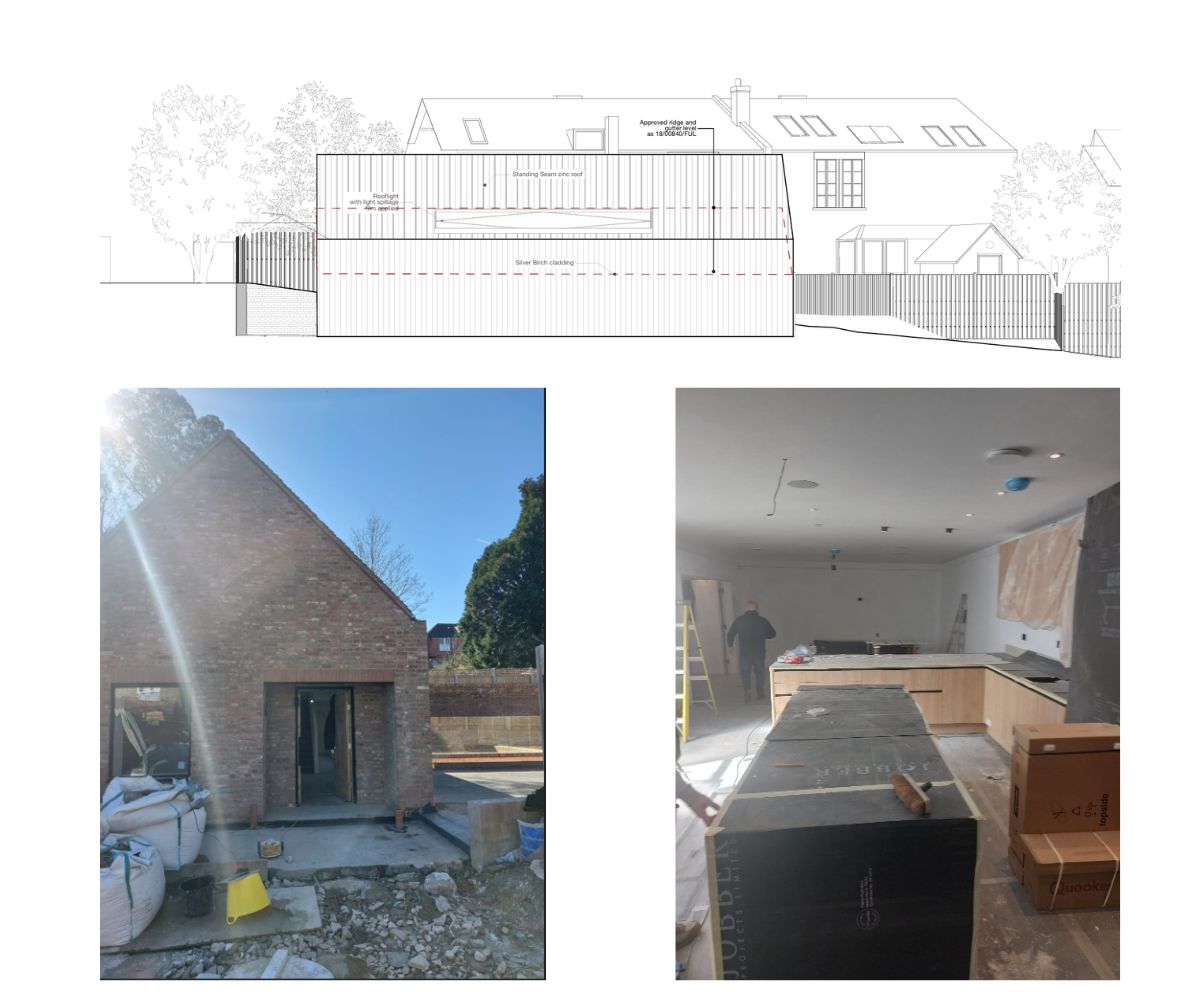

We recently provided a £2.1m development exit loan to a borrower undertaking a residential development scheme in Enfield.

This particular loan helped redeem an existing development facility that was close to expiry, having a gross development value (GDV) of £3m. The borrower had arranged a development exit facility with another lender. But, due to delays in completion and sign-off, the new lender was unable to proceed.

The stats

- Loan size: £2.1m

- Gross Development Value: £3m

- Loan to GDV (LTGDV): 70%

The challenge

Timing was the greatest challenge of this project. Faced with the risk of running into costly project extension fees, we knew that we needed to act quickly and responsibly. Thankfully, due to a coordinated effort across our underwriting, valuation, and legal teams, we met the tight deadline.

This largely came down to the skill of our senior credit team, made up of four members who hold over 100 years of experience between them. They arranged certainty of funding within four working days, which was later completed in a further four days.

How Phoenix helped

With time of the essence, we quickly assessed the situation and funded the deal. As part of the loan, a £100k drawdown facility was included, which the developer used to complete the remaining work on the project.

Flexibility and speed were crucial to the success of this project. Knowing this, we used existing valuations that another lender had obtained whilst also working with solicitors to ensure the process was completed as soon as possible. All this meant we could fund in just eight working days, helping the client avoid costly extension fees with their current lender.

Need prompt finance?

If you’re considering a development project and need a flexible, time-conscious lender, contact Phoenix. We’re based in the UK, offer fixed interest rates, and act quickly. Get in touch with our experienced team of underwriters, advisors, and analysts for help with your next project.